In this chapter, we will explain how Dropshipzone Suppliers are invoiced and how you will receive payment for your products sold.

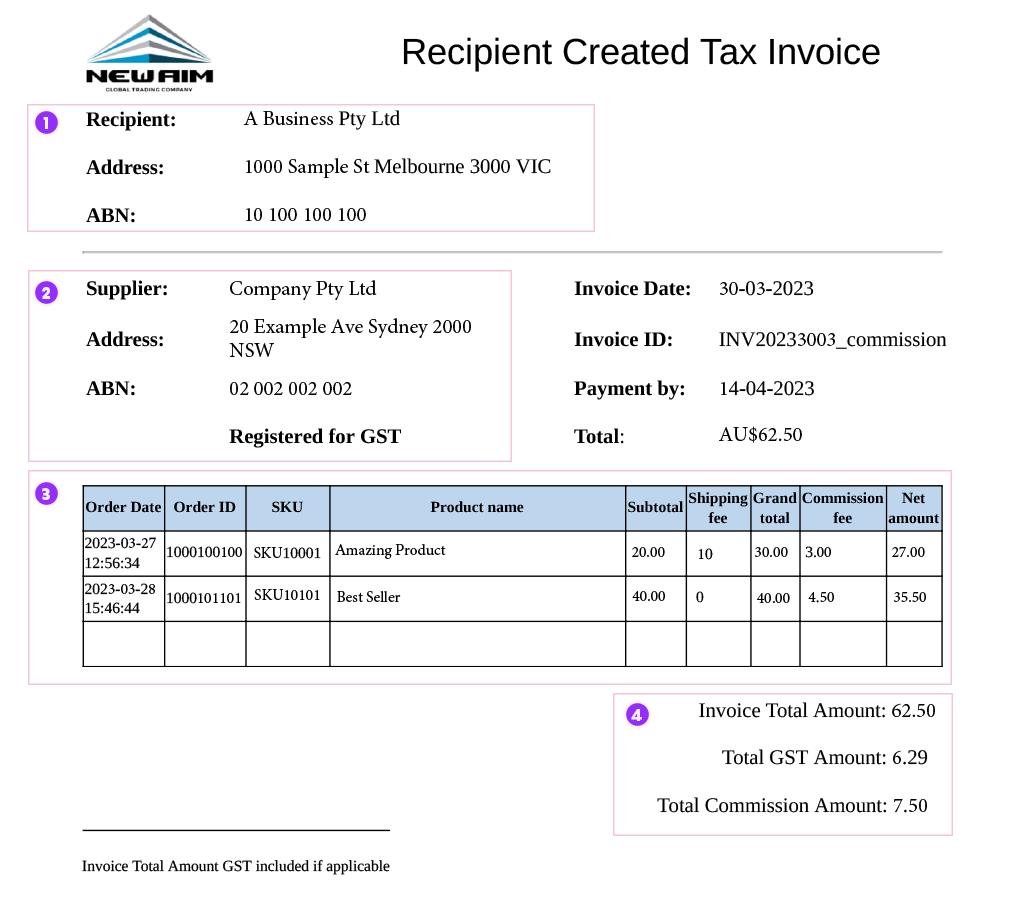

Understanding your RCTI notice

Every Monday morning before 12pm, Dropshipzone will provide active Suppliers with a recipient-created tax invoice (RCTI). This will provide you with order information for the previous week’s orders. The invoice is split into four parts:

- Invoice recipient information.

- Supplier information.

- Order information.

- Total payments.

The Supplier information will include your business information, the invoice date, the invoice ID, when payment will be deducted from your nominated account and the total invoice amount.

The order information table will display the order dates, order IDs, SKU numbers, product names, subtotals, shipping fees, your grand total, commission fees and the net amount earned per order. This is also where any credits or adjustments will be noted.

Below the order information table, you will find the invoice total amount, total GST amount, and total commission amount.

Both the GST and total commission amount will be deducted automatically from your full invoice amount prior to receiving your payment.

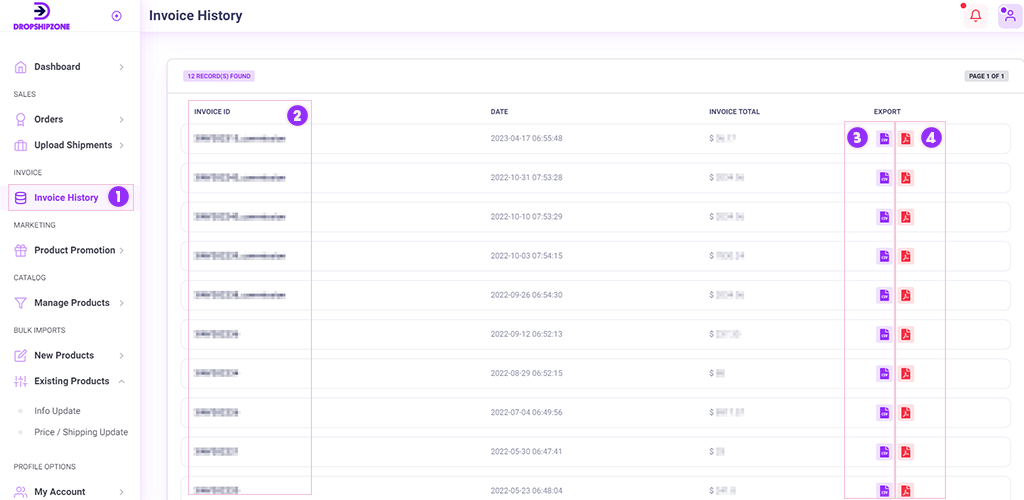

Where to view recipient-created tax invoices (RCTI)

We provide a weekly invoice of the previous week’s shipped orders which can be downloaded from ‘Invoice History’ on the Navigation panel.

- Click the link in your RCTI notification email, input your login details, and you will be able to check the latest RCTI files.

- Alternatively, you can view your new invoice by clicking on ‘Invoice History’ and selecting the relevant invoice.

- You can download the invoice as a CSV file by clicking on the CSV file download icon.

- The PDF file will be your legal invoice. You can download it by clicking on the PDF file icon.

Please note that there is a 14-day notice period for updating bank account details.

Please contact supply@dropshipzone.com.au if you have any questions.

How to issue a credit note or adjustment

To issue or add a credit note or adjustment, please contact the Dropshipzone team at supply@dropshipzone.com.au. The record will show on the next cycle CSV and PDF invoice order details.

When do I receive payments?

Your payment will be sent to your nominated bank account within 7 calendar days after the RCTI has been generated. Once your payment is processed, you will also receive a remittance email from Dropshipzone.

Frequently asked questions

There are some circumstances under which it is more appropriate or convenient for recipients of supplies to calculate or issue an invoice. In these cases, a recipient-created tax invoice is produced. These detail the quantity and value Suppliers are paid for their products, including any handling fees, commissions and deductions.

Every Monday morning before 12pm, we will provide you with an RCTI that contains order information from the previous week. It includes the total GST and commission amounts that will be deducted from your total invoice amount. It will also outline shipping fees and the net amount earned for each sale.

You can access this invoice by following the hyperlink included in your RCTI email notification, or you can click on ‘Invoice History’ under the Invoice tab on your Dashboard. You can view your RCTI as a CSV file or as a PDF file. The PDF file will act as your legal invoice.

Dropshipzone will automatically deduct our commission fee from your total sales prior to receiving your payment.

Dropshipzone will automatically collect GST on behalf of all our Suppliers. We will deduct the GST amount from your total sales prior to receiving your payment.